The Private Equity area is mainly focused on providing capital to Small and Medium Enterprises (SMEs) to boost their growth and sector consolidation. Our main objective is the creation of value in the companies in which we participate, for which we partner with solid and committed businessmen and management teams, investing both through the acquisition of relevant shares and through capital increases, supporting them in the design and execution of its Strategic Plans.

We currently have three investment vehicles under management: Talde Capital Growth FCR €102m, Talde Capital Growth II FCR €117m and Talde Promotion and Development, SCR €63m capital.

Investment strategy

Sector

- Growth sectors

- With consolidation /build-up strategies

Company

- Leading position

- Profitability and scalability

- Clear business model and a unique competitive advantage

Deadl structure

- Investment tickets between €6 - 20M, with company value between €20 - 100M

- Majority or minority positions with shareholders’ agreement

Management team

- Management team aligned with shareholders’ interests

- Permanence and non-compete agreements

Value creation

Corporate development:

- Organic and inorganic growth

- Strategic planning

- Opening of new markets and internationalization

- Implementation in Spain of foreign companies

Knowledge:

- Support in Boards of Directors, contributing our know-how in management, leadership, commercial and institutional relations

- Alignment of interests of different stakeholders

- Professionalization of management, empowerment of management teams

If you are interested in Private Equity Asset Management

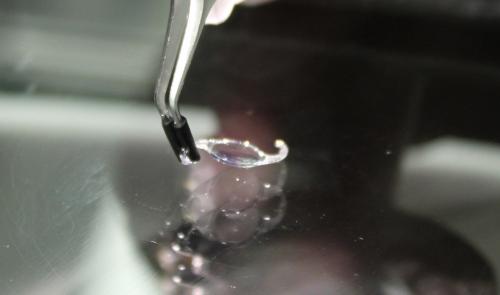

2025 / Private Equity Grupo Siban Peosa With 59 years of experience in the development and manufacturing of conveyor belts. 2024 / Private Equity Plymouth Rubber Group Company specializing in the manufacture and marketing of high-quality adhesive tapes. 2024 / Private Equity 2023 / Private Equity AVS Added Value Solutions AVS is a leading player in high value-added projects in markets as demanding as Space. 2022 / Private Equity Auxitec The Auxitec Group, founded in 2001 and headquartered in Vitoria, is a company dedicated to the distribution of products mainly for the largest... 2021 / Private Equity Bemed-Jemed Group Specialized in the area of traumatology, specifically in osteosynthesis of the upper extremity. 2021 / Private Equity AJL Ophthalmic Founded in July 1992, AJL is a Company headquartered in Álava, specialized in the design, manufacture and distribution of a wide range of medical... 2020 / Private Equity 2020 / Private Equity Engineered Fire Piping Since its foundation, Enginereed Fire Piping has consolidated its growth and position in the market, being present in 31 countries. 2018 / Private Equity Grupo Tegor Development and manufacturing of cosmetic products, dietary and nutritional supplements 2018 / Private Equity Burdinberri Reference in the manufacture of construction elements and tools for the aeronautical sector 2018 / Private EquityPortfolio

News

Talde completes the first closing of its second private debt fund, with €58 million committed

September 30, 2025View more

Talde Promoción y Desarrollo S.C.R., S.A., holds its annual General Meeting of Shareholders and approves a dividend

July 16, 2025View more