Agotzaina

Consumer Goods

Arbizu, Navarra

2024

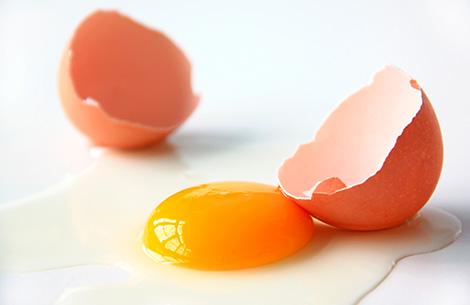

Egg products and derivates

Corporate Loan

Talde supports Agotzaina's growth with long-term loan

Founded in 1985, Agotzaina has become a major player in Spain's agri-food industry. Initially specializing in the poultry sector and pasteurized egg products, the company has since expanded its reach. Agotzaina now offers white and Iberian pork alongside a variety of produced and packaged goods, including fruit and cheese.

The agri-food sector is experiencing a wave of consolidation, and Agotzaina is at the forefront of this movement. The company is pursuing a dual growth strategy, combining organic expansion with strategic acquisitions.

Talde's long-term loan provides Agotzaina with the financial backing needed to execute its growth plans. This investment will allow the company to solidify its position in the market, focusing on both volume growth and maintaining the high reliability and quality of its products. Agotzaina has set a bold objective of reaching a turnover of €1 billion by 2030.

Market consolidation process

Main characteristics

Agotzaina enjoys a privileged position in a consolidating market, where strong bargaining power is key.

This success is fuelled by the group's robust financial health, boasting both healthy profitability and a solid balance sheet bolstered by physical assets and low debt levels.

To further solidify its position, Agotzaina continues to invest in both organic growth (internal expansion) and inorganic growth (acquisitions) while prioritizing sustainability through a commitment to free-range and organic hens.

Bargaining power

As the company grows, Agotzaina acquires bargaining power to improve its margins.

Highlights

Market Share

Agotzaina produces 12% of the eggs consumed in Spain; its aim is to increase its share to 25%.

Growth & Profitability

Exponential growth in recent years, improving margins with financial strength

Full Vertical Integration

To face the ups and downs of the market from a privileged position